Golden Crown Casino official site for Australia Login

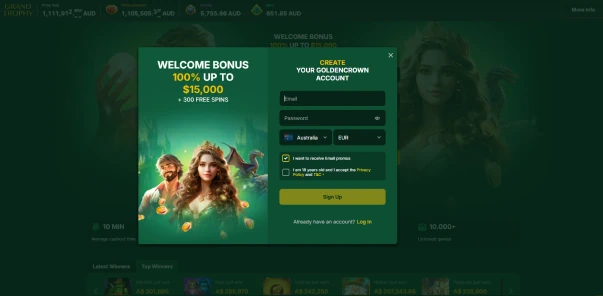

Registering and logging in at Golden Crown Casino follows a standard online casino process with defined security steps for Australian players. This guide explains how registration, login, bonuses, payments, and security features work.

| Parameter | Details |

| Brand | Golden Crown Casino |

| Operator (owner) | Hollycorn N.V. (Curaçao, reg. 144359) |

| License information | Curaçao Gaming ( OGL/2024/263/0069) |

| Payment informaiton | min deposit is $20

min withdrawal amount is $20 max amount – is $5,000 per any transaction |

| Current promos | Welcome bonus: up to $7,000 + 500 Free Spins

Weekly cashback: up to $5,000 Bonus buy-back: 20% |

| Support | [email protected] Required for Website Registration |

Information Required for Website Registration

Before registering at a site online, players should know which personal and account details are required. Preparing this information helps complete registration process, login, and verification:

| Information Category | Specific Details Required | Purpose & Notes |

| Personal Identity | Full Legal Name, Date of Birth | Mandatory for age verification and KYC checks. Must match official ID. |

| Contact Details | Current Email Address, Mobile Number | Used for account confirmation, promo code notifications, and support. |

| Account Security | A Strong, Unique Password | Protects your account for casino online login. |

| Location & Currency | Residential Address, Country, AUD Currency | Confirms eligibility for services and sets transaction currency. |

Golden Crown Casino operates under a Curacao eGaming license, which authorizes international online casinos to legally provide gambling services and platform access to players located in Australia

Having personal, contact, and location details ready helps complete registration at Golden Crown Casino more efficiently. Accurate details help avoid registration errors and support faster account verification. Providing correct information is fundamental for passing subsequent KYC verification, which is required to access all features and withdraw winnings. Ultimately, this upfront organisation helps you start your journey at this casino without delay, allowing you to focus on exploring games and claiming your bonus.

Benefits of Registering on the Website

Creating an account allows players to access games, bonuses, and account features at Golden Crown Casino. Registration enables players to use casino games, bonuses, and payment features:

- Accessing the complete library of slots and live casino games;

- Claiming the generous welcome bonus and all subsequent bonuses;

- Being eligible to receive exclusive promo codes via email;

- Managing secure deposits and withdrawals in AUD;

- Utilizing the full features of the mobile casino site or the mobile app.

Registration is the essential key that transforms you from a visitor into a full-fledged member of this community.

Password Requirements

A strong password helps protect access to your account. Golden Crown Casino typically enforces requirements to ensure account security:

- Minimum length (often 8-12 characters);

- A mix of uppercase and lowercase letters;

- Inclusion of at least one number;

- Inclusion of at least one special character (e.g., !, @, #, $);

- Avoid using easily guessable information like your name or “password123”.

Creating a strong password helps prevent unauthorized access to your account. Adhering to requirements for length, character variety, and complexity builds a strong barrier against unauthorized access. Setting a secure password helps protect account access, funds, and personal information.

Password Recovery

If you forget your password, the recovery process is simple and secure:

- On the login page, click the “Forgot Password?” link;

- Enter the email address associated with your account;

- Check your inbox for a password reset email containing a unique, time-sensitive link;

- Click the link and follow the instructions to create a new, strong password for your login.

The password recovery system allows players to restore account access through email verification. By following the instructions on the login page, players can reset their password and regain account access.

Bonuses and Promotions

Golden Crown Casino offers bonus promotions for new and existing players in Australia. Understanding bonus terms helps players use promotions effectively.

Promo Codes

Promotional codes are used to activate bonus offers. A promo code can unlock various rewards:

- Free spins on specific slot titles;

- free chip offers for extra betting credit;

- Enhanced deposit match percentages beyond the standard welcome Casino bonus;

- You can find these codes on the casino’s promotions page, in newsletters, or on affiliated review sites.

Promo codes allow players to activate free spins, bonus credit, or deposit matches. Whether it’s free spins, extra betting credit via free chips, or a boosted deposit match, these codes significantly amplify the player’s experience. Actively seeking out these codes on the casino’s promotions page or partner sites is a smart strategy for any player looking to maximise the value of their time.

No Deposit Bonus

One available offer for new players is the no deposit bonuses. It occasionally provides incentives that require no initial investment. They allow you to explore the game portfolio risk-free, though they come with specific wagering requirements. The bonus codes represent a unique and highly sought-after opportunity for new players to engage with the platform without financial commitment.

Bonus Golden CrownFinancial Operations on Golden Crown Casino

Deposits and withdrawals follow defined processing rules and limits. The platform supports a range of trusted payment methods for Australian players:

| Operation Type | Key Details | Important Notes |

| Deposits | Methods: Credit/Debit Cards, POLi, Neosurf, Skrill, Bank Transfer. Speed: Instant. Min. Amount: Typically $20 AUD. | Funds are available immediately to play games or claim a Golden Crown Casino bonus. |

| Withdrawals | Methods: Bank Transfer, Skrill, Neteller.

Speed: E-wallets: 12-24hrs; Bank Transfers: 2-5 business days. Min. Amount: Usually $30 AUD. |

Withdrawals are subject to security approval and KYC verification. Limits are displayed in the cashier. |

This efficient system, coupled with a variety of trusted local payment methods, ensures that managing your funds at this casino is a straightforward and secure aspect of the overall gaming experience.

Mobile Application

Golden Crown Casino offers a mobile app for players who prefer to play on smartphones or tablets. The application is available for both iOS and Android devices. The mobile app mirrors the main website’s core features and just like the desktop version provides access to games, bonuses, payments, and account features from supported devices.

Security and Data Protection

Golden Crown Casino uses licensing, encryption, and account security measures to protect player data and transactions. To protect all transmitted data, casino uses 256-bit SSL encryption, the same industry-standard security measure trusted by major financial institutions. Furthermore, a clear and comprehensive privacy policy outlines the compliant collection, use, and protection of your personal information. Finally, the security of the login process itself is a key focus, with the platform encouraging players to use strong passwords and enabling two-factor authentication where available for an added layer of account protection.

Customer Support

Players can contact customer support for assistance with registration, login, or gameplay. The customer support team is accessible 24/7. The most efficient way to get help is via the live chat feature integrated into the website. For detailed queries or document submission, you can also contact the support team via email.